November 14, 2021 at 06:00AM

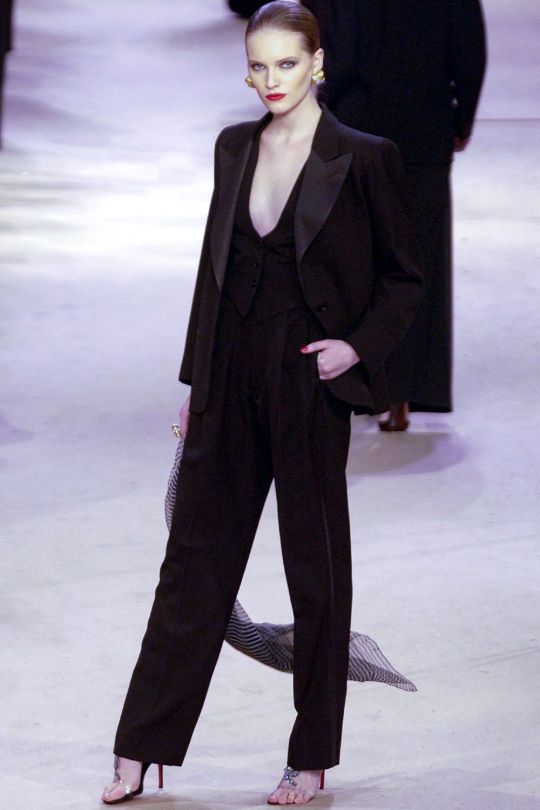

As Chanel’s glossy-haired models hit the S/S 22 runway, the soaring melody of George Michael’s “Freedom! ‘90” blasted out of the speakers, and the densely packed photographers that lined the runway snapped away. With big shoulder pads, glittering tweed and jewellery dripping in the brand’s interlocking-C insignia, it felt as though we had been transported back to one of Chanel’s iconic 1980s runway shows. “I used to love the sound of flashbulbs going off at the shows in the eighties, when the models were on a raised runway,” mused Chanel’s creative director, Virginie Viard, in the show notes. “I wanted to recapture that emotion.” The headline was clear: Nostalgia is big news.

The world of luxury fashion is no stranger to vintage style. Historic fashion houses, such as Chanel, YSL and Dior, regularly dive into their own archives, digging out old motifs, silhouettes and prints and weaving them into new collections. The hallmark of any new creative director is often formed by their adherence to, or rebellion against, the brand’s historic design DNA. Yet over the last year, there has been one significant gear change: Forget modern reworkings of bygone trends because luxury fashion has finally realised the power of the vintage items themselves.

You don’t need to look far to see that the demand for resale is on the rise. In March 2021, luxury fashion group Kering (owner of Gucci, Bottega Veneta and Balenciaga) made headlines by acquiring a 5% stake in resale platform Vestiaire Collective, and in April, Lyst reported that searches for “vintage,” “second-hand” and “pre-owned” jumped 32% compared with the previous year.

“The appetite for vintage and second-hand fashion will continue to grow as Gen Zers and young millennials seek comfort in the cultural products of past decades”, explains Morgane Le Caer, content lead at Lyst. “Brands that were popular years ago have been making a comeback, with searches for denim brand Evisu increasing 83% within the past three months and Jean Paul Gaultier are up 53%. Jean Paul Gaultier’s rental service and Prada’s Re-Edition collection prove that it is important for luxury brands to stay on top of the movement.”

ADVERTISEMENT

ADVERTISEMENTKate Spade Autumn/Winter Sale |

For Gen Z, a generation that has grown up with access to resale platforms such as Depop, preloved fashion is simply an integrated part of the way they shop, but what will be notable is how this behaviour adapts as they move into their 30s and 40s and their spending power increases. As luxury brands dip their toe into the resale sector, it foreshadows a more commercialised future for second-hand (an industry that hasn’t exactly been known for its mass appeal or polish), one that meets the market’s changing needs. You need only look at Gucci Vault to see the potential. With professionally shot imagery and an enviable product edit, the platform sells pieces from the brand’s vintage back-catalogue alongside upcycled collaborations with up-and-coming designers and packs all the gloss and glamour you’d expect from a luxury e-commerce site.

Mulberry is another high-end brand that has clocked the importance of incorporating second-hand into its business model. In February 2020, the brand launched Mulberry Exchange in-store, which then expanded to include an online buy-back-and-resell service, offering customers a chance to have their bags authenticated by in-house experts before being sold on, with the value put towards a new purchase.

“We knew that the resale market was thriving, but when we looked at the Mulberry product that was available through the established resale channels, we could see that much of it was in poor condition or that customers could not be certain they were buying authentic Mulberry,” explains a representative from the brand. “We see the Mulberry Exchange services as a way of extending the same level of quality, excellence, service and attention to detail to the resale sector that we offer across our new collections.”

Fashion brands are realising that this move towards resale will happen with or without their participation, and by ignoring it, they run the risk of getting left behind and letting others cash in on their archival collections. “Resale platforms continue to raise funding, but the environments are not necessarily conducive to any particular brand’s storytelling,” explains journalist Rahul Malik in The Business of Fashion. “If platforms are going to make the brand’s inventory available, and consumers are going to see and potentially buy it, should the brand not at least seek to influence the experience?”

One of the most significant players to enter the resale space over the last year has been multi-brand retailer NET-A-PORTER, which is known for its comprehensive luxury brand portfolio and high-spec customer service. It’s a notable win for the second-hand cause. Partnering with resale specialist Reflaunt, NET-A-PORTER now offers shoppers a reward-driven platform that not only promotes a more circular approach to consumption but also gives shoppers a financial incentive to experiment with resale.

“We’ve been seeing ever-increasing interest in this space and are excited to see how our community will use this service to maximise the value of their high-quality luxury,” explains NET-A-PORTER Chief Buying and Merchandising Officer Lea Cranfield. “For me, it all comes back to quality. We know that seasonal trends can come back in style, and being able to draw on vintage pieces that can stand the test of time and have been well cared for can complement and bring a unique edge to our wardrobes. I also think throwback trends, such as the current Y2K movement, will rise and endure due to well-preserved archive pieces from these eras becoming more accessible. We believe resale can influence a longevity mindset for fashion and expect this to have a knock-on effect for how people invest in luxury pieces and care for them.”

NET-A-PORTER follows in the footsteps of Farfetch.com, which was one of the first platforms to harness the one-of-a-kind appeal of luxury vintage. The website launched its resale category back in 2010 with an edit of second-hand items sourced from its community of boutique partners. “We offer a range of services, from Farfetch Donate to Farfetch Second Life, to ensure that engaging in circularity is easy and approachable for our customers,” states senior women’s editor Celenie Seidel. “The response has been incredibly encouraging and a true indication that an increasing number of people are really considering where they direct their spend and how they can incorporate pre-owned items into their wardrobes.”

These moves from some of the industry’s power players are certainly good PR for the second-hand market and integral to making it an appealing prospect for first-timers. But for an industry that has historically been driven by newness, incorporating resale can seem an intimidating prospect, particularly from a logistics point of view. This is where innovative technology platforms, such as Reflaunt, come in.

The brains behind many of these luxury resale moves, Reflaunt helps platforms to enter the resale market and empower their own customers to resell or recycle their past purchases. The brand recently worked with Ganni to introduce a feature on the website whereby customers are able to select resell items in the same way you would press return to buy a new purchase. Once sold, the customer can then choose to receive a cash payback for the sale minus a Reflaunt commission or choose to receive the full sale price and a top-up in Ganni.com credits.

ADVERTISEMENT

ADVERTISEMENTSports Direct Free Delivery on All Orders! |

“The main concern fashion brands have is around cannibalisation and the effect it may have on their first-hand business, but the reality is that customers are already selling their pieces, so the brand can choose to ignore this and not reap the benefits,” explains Reflaunt CEO and founder Stephanie Crespin. “In 10 years’ time, we think the most successful brands will have fully integrated resale throughout their business. I look forward to seeing retailers really consider the whole lifecycle of a product from start to finish, not just focused on making that one-off sale.”

As with any industry-wide change, it is not without its downsides, and as a lifelong vintage shopper, I think about the impact of luxury brands reclaiming their vintage collections and selling them at elevated prices on smaller sellers. Will this mean that second-hand clothing becomes out of reach to the average person and loses the personal touch of homegrown businesses?

“Obviously, I can’t deny that any opportunity to create a circular model is a positive one. Pushing these pieces into the mainstream makes second-hand more accessible, both in terms of the actual pieces reaching more people and elevating the conversation around a modern wardrobe that consists of new and old pieces,” says Clare Lewis, founder of Retold Vintage. “But it could be interpreted as yet another greenwashing exercise by these large brands and an opportunity to cash in on the increasing growth of the resale market. Half of the magic of vintage is hearing past life stories, who it belonged to, where it was found, etc., and smaller vintage businesses are so much better at being able to offer this personal touch.”

Perhaps the secret to second-hand’s long-term success is acknowledging the varying needs of consumers. If we can create a fashion market that offers both high-street and designer, then perhaps vintage can have its own spectrum, with charity shops and pre-loved high-street at one end and the new luxury offerings at the other. Bay Garnett, stylist and host of This Old Thing, which is sponsored by eBay, summarises it perfectly: “Are there any downsides to this change? I think anything that will make people buy and love more vintage is great, however it is presented. I think that people who love second-hand will always go to the smaller, more curated and edited sites. People love a secret and a hunt! But I think there will be something for everyone in the future of second-hand.” Amen to that.

ADVERTISEMENT

ADVERTISEMENT

Anya Hindmarch - I AM A PLASTIC BAG

Up Next: How to Find the Best Vintage Pieces, According to a Second-Hand Expert

Author Joy Montgomery | Whowhatwear

Selected by CWC

ADVERTISEMENT

ADVERTISEMENTUp to 30% off Gift Sets |